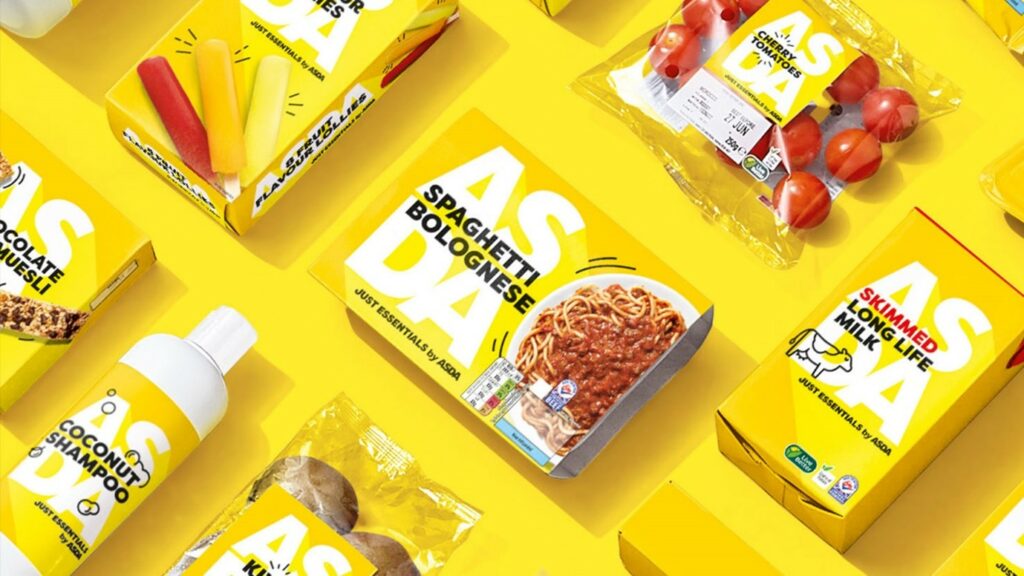

Before ‘cost-of-living’ or the more favourable, light-hearted phrase ‘cozzie-livs’ became a key buzzword in our society, for many people, the thought of purchasing own label products when completing their big shop, was always considered the ‘less favourable’ option with many shoppers thinking of these products as cheaper imitations. However, with this recent new societal shift, consumers and retailers are now seeing the value in investing in own-label products. Many retailers are now facing the challenge of making their own-label products more attractive to consumers, steering them away from renowned, big-name brands. Due to the rise in inflation, it was reported that 7 in 10 (70%) of consumers have acquired a taste for supermarkets’ own-label brands and have no intention of reverting to more household (and expensive) names. It definitely appears that there has been a massive shift in consumer attitudes. It’s clear that shoppers’ priorities have changed, with many questioning the value in private-label products. It was recently reported that, 47% of people have reported to now feeling indifferent when buying own-label, while 27% say they feel ‘savvy’. Only 3% of people reported that they felt embarrassed. Because of this change in response, we can only expect to see an increase in growth for own-label products, even beyond this living crisis. Previously when thinking about own-label products, many associated the term with value. Often the branding and marketing for these products were very minimal and plain, however with an increase in investment today, brands have blossomed their product development plans after seeing the rise in popularity and the rise in sales from the growing demand of more affordable food products. It was reported last year that Asda invested £19.5m into the complete overhaul of their own-label meal solutions range, introducing a variety of new dishes at a discounted price. Their investment into their branding aimed to improve quality perceptions and drive growth within Asda’s own-label category. From this, we can expect supermarket retailers to continue their push in investment. It was reported last year, sales of own-label products now account for 54.7% of grocery sales. Because of this, retailers will continue to expand their efforts expanding and freshening up their offerings. Speaking on the performance of own-label products, Group CEO Greg Phillips comments: “Own-label will continue to sky-rocket in popularity and performance, as supermarkets continue to invest in innovation and lowering prices. The bar will continue to be raised with more premiumisation in own-label, particularly across the big four”. Supporting this, late last year, it was reported that Sainsbury’s doubled the amount of their own-label products in its local convenience stores. This reaction came after a Which? Consumer group called out supermarkets for not stocking enough value products in their convenience stores. In addition to this, luxury department store, Liberty is widening its range of own-brand products, aiming to capitalise on these products which have more generous margins and can deliver a competitive advantage. Speaking on premiumisation, many beloved big brands are now deploying tactics to ensure they remain a firm favourite for shoppers looking for a bargain. These brands understand that whilst consumers value affordability, many do not want to compromise on the quality. As a result, many big brands have increased their focus on branding, making significant changes to packaging and even their company slogans. Packaging has now become so important because that is the only way big brands can put up a fight against much cheaper alternatives. Moreover, national brands are having to find new ways to prove themselves as more innovative. A great example of this can be spotted by drinks brand, Tropicana who have recently introduced an ‘ambient’ drink range aimed to impress private label shoppers. Many big brands have also turned to focus on ergonomics focusing on the ways consumers interact with the products, offering a vantage point that own-label brands can’t compete with due to costs. At one point, it was even rumoured that Heinz were going to introduce a double-lid ketchup bottle. Whether this was fact or fiction, we can expect brands to be stepping up in terms of innovation, really looking to ‘woo’ customers into buying in and staying loyal. Continuing his thoughts on what we can expect for own-label products, Greg comments: “There will be lots of interest around price and proposition this year, supermarkets will need to continue to compete against each other in the race to lowering prices for shoppers' everyday essentials, this is because shoppers’ loyalty is at an all-time low with the majority trying to find the cheapest supermarket within their area.” Supporting this, it was recently reported that Sainsburys have invested £220 million into lowering prices for their customers. With this investment, the retailer focussed on cutting prices on the products customers buy most often and invested in market-leading deals with Nectar Prices. It’s clear that this retailer has been clever about when to bring their names to the fore on products. In order to gain customer loyalty, the retailer also increased their ‘Aldi Price Match’ campaign to a total of 550 products. As Greg highlighted, customer loyalty is at an all-time low meaning that their selling points have the power to put them at an advantage. Retailers must appear to be on the side of the shopper, showing that they are actively wanting (and trying) to keep prices affordable for shoppers. In addition to this, Waitrose has recently cut prices across the board in attempt to win back middle-class shoppers from M&S. The landscape for own-label products in 2024 appears to be promising. The traditional stigma of these products as budget alternatives has significantly diminished, replaced by a newfound appreciation among consumers and retailers alike. With the rise in own-label sales and increased investment from supermarkets, it’s clear that own-label product ranges are transforming into their own powerful new brands. Consumers have completely changed their perspective, now viewing these products as genuinely desirable brands, often thanks to new and improved branding and marketing. As a result, in future we could expect to see some own-label products outpacing national brands. Big-name brands are not conceding defeat; instead, they are adapting their strategies focusing on brand experience, packaging, branding, and product innovation. In this fiercely competitive market, the race to lower prices and maintain customer loyalty remains paramount. With innovation in mind, if you’re a brand who’s looking to capture the hearts of existing and potential shoppers, it’s important that you align yourselves with experts who can help to create unforgettable experiences. That’s where Dee Set comes in – our end-to-end services offer retailers and brands alike with maximum support. From improving FSDU visibility to supporting multi-channel fulfilment, we’ve got you covered. What’s more, to stay ahead, it’s essential that brands keep a close eye on their industry competitors to avoid getting left behind. Reapp Insight, part of Dee Set Group’s data and tech arm, is your key to the big leagues, giving you access to a mass of retailer data in one comprehensive suite. If you’re looking to regain control and increase visibility over what’s going on with your products in-store, Reapp is your secret weapon, priming you for success. Own-label products are the unexpected hero of the cost-of-living crisis, they have helped consumers realise that they can have both affordability and quality. It's clear that own labels will surpass our tough economic times. The sustained popularity, increasing demand from consumers, and global triumphs highlight their significance in shaping the future of the grocery sector. In this competitive landscape, it’s clear that own-label products are the ‘ones to watch’, it will surely be interesting to see which big-name brands maintain their market position in the following months by adopting new marketing strategies and pioneering innovation. Who will be replaced by a cheaper alternative and who will hold brand loyalty? Stay tuned!Acquiring a taste for own-label goods

Supermarket retailers are holding their own

How beloved, big name brands are fighting back

A focus on innovation

Keeping prices low, maintaining customer loyalty

Own-label products are the unexpected heroes of the cost-of-living crisis