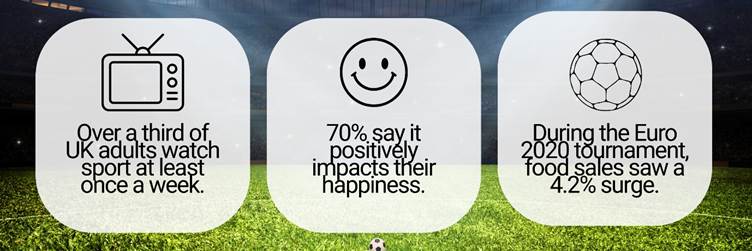

UK consumers are more selective than ever about where they spend their money, and retailers and brands are competing in an increasingly crowded retail and media landscape. With attention fragmented across platforms and in-store competition at its peak, standing out has never been harder. Yet sport continues to cut through, providing a potential uplift for those who want to be part of the game. It was recently reported that over a third of UK adults watch sport at least once a week, and 70% say it positively impacts their happiness (YouGov). During major sporting moments, audiences are more emotionally engaged, receptive to messaging, and more likely to act, creating a powerful window for brands and retailers who are prepared to show up strategically. Crucially, you don’t have to be a die-hard sports fan to feel the impact. The summer of sport appears everywhere: headlines, social feeds, in-store promotions, and limited-time offers that shape consumer behaviour and drive spending. Summer 2026 promises one of the most action-packed sporting periods in recent memory, delivering heightened attention, emotion, and commercial opportunity. A Packed Sporting Calendar in 2026 The UK sporting calendar in 2026 is filled with high-profile moments that attract diverse audiences, dominate mainstream culture, and drive both footfall and spending. Each event has unique audience characteristics and commercial opportunities: Glasgow 2026 Commonwealth Games Audience profile: Broad, multi-generational audiences with strong regional and national pride. ICC Women’s T20 World Cup Audience profile: Younger, digitally engaged audiences with a strong Gen Z and millennial skew. Wimbledon (29 June – 12 July) Audience profile: Affluent adults, ABC1 households, lifestyle-driven consumers. British Grand Prix (5 July) Audience profile: Experience-driven fans with strong brand affinity and disposable income. Royal Ascot (16 – 20 June) Audience profile: Affluent, fashion-led, and social-occasion shoppers. The Grand National (11 April) Audience profile: Traditional sports fans with strong social viewing habits. Six Nations Championship Audience profile: Loyal, repeat viewers with social and pub-style habits. UK Retail Behaviour & Category Trends Major sporting moments influence how, when, and why UK shoppers buy. Understanding these patterns allows brands to align activation, ranging, and supply for maximum impact. Food & Drink: Social viewing and “Big Night In” occasions drive shared consumption, multipacks, and impulse purchases. Retail Week recently reported that more than 48% of consumers eat crisps, snacks and nuts during streaming evenings. Additionally, Sharing formats have become the largest segment in the salty snacks category, accounting for 69.4% of sales. Promotions and in-store theatre close to fixtures increase conversion. BWS: Alcohol behaviour is evolving. Traditional spikes are now complemented by growth in low- and no-alcohol alternatives. Premiumisation is strong for events like Wimbledon and Royal Ascot, particularly with younger audiences. It was recently discovered that 10% of BWS shoppers are influenced by the desire to try a new flavour or type when making their product choice, highlighting that differentiation can be an influencing factor on the shop floor. Convenience & Impulse: Live fixtures create time-specific demand spikes. Convenience stores play a key role for last-minute top-ups, meaning availability and visibility are crucial. Convenience Store, recently reported that although shoppers are being cautious with their money, they still expect quality and convenience. Outdoor & Seasonal Categories: Summer sporting events coincide with better weather and outdoor socialising. Portable, on-the-go, and event-adjacent formats see increased relevance. IDG reported that Health is becoming more important to consumers, with 58% of food-to-go consumers claiming that having healthier options was important to them. Events like Wimbledon and the British Grand Prix blur the lines between sport, healthy lifestyle, and leisure, offering opportunities beyond traditional categories. Retailers and Brands Best Positioned to Capitalise Retailers: Supermarkets, convenience & forecourt stores, sports & leisure retailers, department stores and multiples. Brands: Beverages (high-energy, low/no alcohol), snacks & confectionery, and sports apparel. The key is aligning activation to the right event, category, and audience. Why Sport Still Wins in the Attention Economy Sport captures attention at scale due to its emotional intensity, cultural relevance, and unpredictability. It’s highly inclusive, with fans engaging physically or virtually, in stadiums, at home, in pubs, or via mobile devices. For brands, this means sport remains one of the few environments capable of delivering highly engaged, diverse audiences who are receptive to messaging and more likely to trial, impulse buy, or switch brands. How Brands and Retailers Can Capitalise A Data-Centric, Insight-Led Approach Understanding audience behaviour is critical to succeed in competitive retail spaces. By pooling robust first-party data and analysing performance in real time, Dee Set helps brands deliver targeted, relevant messaging and make proactive operational decisions. Why it’s essential: Sports audiences are diverse and fast-moving, and traditional marketing approaches risk missing key opportunities. A data-led approach ensures campaigns are optimised for impact, allowing brands to connect with the right people at the right time. How this works: Stand-Out FSDUs and In-Store Visibility: Sport’s mass-market appeal allows brands to reach multiple audiences simultaneously. Eye-catching Free-Standing Display Units (FSDUs) and tailored in-store execution help brands command attention and drive impulse purchases. Why it’s essential: Retail environments are highly competitive, especially during major sporting events when promotions and limited-time offers peak. Stand-out FSDUs provide maximum visual impact, ensuring your brand doesn’t get lost on the shelf. Well-executed in-store visibility reinforces marketing messages from experiential campaigns and digital content, creating a seamless multi-channel experience that drives sales. Set assembles and fills displays efficiently, ensuring they meet brand standards and are strategically positioned. Experiential Activations: Through sister brand Reach, Dee Set creates immersive activations at high-energy sporting environments. These build emotional connections, boost brand recall, and turn attendees into long-term advocates. Merchandising That Delivers: Merchandising is the bridge between strategy and execution. Even the most creative campaigns fail without flawless in-store representation. These teams guarantee that brand standards are maintained, products are kept in stock, promotions are executed accurately, and opportunities to convert fans into buyers are maximised. Our specialist teams ensure brand compliance, visibility, and flawless execution, just take your pick: Product & Supply: Seamless Fulfilment: We provide flexible, personalised product and supply services to remove friction during peak trading periods. Timely and accurate supply ensures products are available when demand peaks, particularly during major sporting events. Delays or stock-outs can result in missed sales and lost loyalty. Dee Set’s meticulous fulfilment process guarantees consistency, reliability, and peace of mind, allowing brands to focus on marketing, engagement, and growth rather than logistics. Dee Set offers end-to-end fulfilment with: Want more insights on how to win this season? Download our free Summer of Sport checklist and discover key strategies and tips to maximise performance and engagement this season. Make the Most of the Moment The summer of sport is a once-a-year commercial opportunity. Brands that combine insight-led planning, standout activation, and flawless execution turn short-term hype into long-term loyalty. At Dee Set, strengthened by the comprehensive and integrated services of Acosta Europe, we make it stress-free, from planning to fulfilment, helping you convert passionate fans into returning customers. Ready to win the summer?

Behavioural insight: Multi-sport tournaments drive repeat viewing and shared consumption, particularly among families and social groups.

Category opportunity: Family-friendly snacks and soft drinks, big-night-in bundles, multipacks, and impulse-led items with high visibility.

Behavioural insight: Audiences expect inclusive, values-led brands; Gen Z drinks less alcohol and prioritises wellbeing and sustainability.

Category opportunity: Zero and low-alcohol drinks, functional beverages, healthier snacking, and purpose-driven experiential activations.

Behavioural insight: Wimbledon is as much a cultural occasion as a sporting event, with shoppers receptive to premiumisation and occasion-led purchases despite the cost-of-living crisis.

Category opportunity: Premium food and drink, non-alcoholic alternatives, summer entertaining, gifting, and seasonal ranges.

Behavioural insight: Motorsport audiences value exclusivity, performance, and innovation. Immersive experiences and limited-edition offers perform strongly.

Category opportunity: Energy drinks, convenience-led food, limited-edition or on-the-go products, and high-impact in-store displays.

Behavioural insight: Blends sport with luxury and celebration, driving spend around socialising and gifting.

Category opportunity: Premium drinks and alcohol alternatives, beauty/fashion/lifestyle adjacencies, and elevated in-store theatre.

Behavioural insight: Early-year sporting moments act as commercial warm-ups, boosting impulse purchasing and promotional responsiveness.

Category opportunity: Event-led promotions, snacks and drinks for shared occasions, and short-term FSDUs.

Behavioural insight: Builds momentum over several weeks, encouraging habitual viewing and repeat purchasing.

Category opportunity: Multi-buy food and drink offers, big-night-in and sharing formats, and consistent stock availability to meet repeated demand.

Get in touch with our team to discover how we can support every stage of your summer of sport strategy.